Bitcoin’s resilience over the years underscores its staying power, even as it continues to face scrutiny and skepticism. From its inception as a niche digital currency to its current status as a global financial asset, Bitcoin has defied predictions of its demise by thriving on decentralization, transparency, and a capped supply. Its ability to act as a store of value, a hedge against inflation, and a tool for financial inclusion has attracted attention from retail investors, institutions, and even governments. However, its ultimate role in shaping the future of finance and technology remains uncertain, hinging on regulatory developments, technological scalability, and societal adoption. Only time will reveal the full extent of Bitcoin’s relevance in the ever-evolving economic landscape, but its foundational principles ensure it remains a pivotal part of the conversation.

Acknowledging here that there are MANY crypto currencies available that are a part of this revolution. I just happen to be a BITCOINer!

None of this is financial advice…obviously! 🙂

Some BITCOIN 101…

Bitcoin is a decentralized digital currency that operates on a peer-to-peer network, allowing users to transfer value without the need for intermediaries like banks or governments. It was created in 2008 by an anonymous entity or individual using the pseudonym Satoshi Nakamoto and was launched as open-source software in 2009.

Here’s an overview:

Key Features

- Decentralization

Bitcoin is not controlled by any central authority, making it resistant to censorship or manipulation. - Blockchain Technology

Transactions are recorded on a public ledger called the blockchain, which ensures transparency and immutability. - Limited Supply

Bitcoin has a capped supply of 21 million coins, designed to make it deflationary over time. - Mining and Proof-of-Work (PoW)

New bitcoins are created through mining, where powerful computers solve complex cryptographic problems. This also secures the network. - Pseudo-Anonymity

Transactions are linked to Bitcoin addresses, not personal identities, providing a degree of privacy. - Divisibility

One Bitcoin can be divided into 100 million smaller units called satoshis, enabling microtransactions.

How Bitcoin Works

- Sending and Receiving

Users send Bitcoin by signing transactions with their private keys, and these transactions are verified by miners and added to the blockchain. - Security

Bitcoin uses advanced cryptographic techniques and is considered highly secure. However, users must safeguard their private keys. - Wallets

Bitcoin wallets (software or hardware) store private keys and manage transactions.

Use Cases

- Digital Payments: Enables fast and global transactions.

- Store of Value: Often referred to as “digital gold” due to its deflationary nature.

- Decentralized Applications: Used in blockchain-based apps, though other networks like Ethereum are more common for this.

Advantages

- Low transaction fees compared to traditional banking systems.

- Borderless transactions without currency conversion issues.

- Protection from inflation due to its fixed supply.

Challenges

- Regulatory Issues: Governments have varied stances, ranging from adoption to outright bans but more nation’s seem to be taking an interest in the recent past.

- Scalability: The network can handle only a limited number of transactions per second.

Current Trends

Bitcoin’s price and adoption have grown significantly, with major corporations, financial institutions, and even countries (e.g., El Salvador) integrating Bitcoin into their economies. It also plays a central role in the broader cryptocurrency ecosystem.

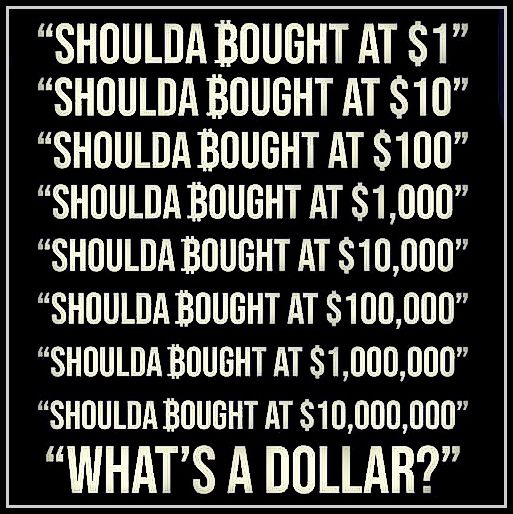

Currently, Bitcoin is experiencing significant market momentum, with its price recently crossing the $90,000 threshold and on track toward the psychological milestone of $100,000 by the end of November 2024. This rally is fueled by several factors:

- Post-Halving Effects: Following Bitcoin’s halving event in April 2024, which reduced mining rewards, the limited supply has contributed to upward price pressures, as seen historically in post-halving periods.

- Institutional and Retail Interest: Increased adoption of Bitcoin ETFs and integration into payment systems have driven demand. Institutions are showing robust interest, particularly in the wake of regulatory clarifications and ETF approvals.

- Technical Indicators: Bitcoin’s technical charts remain bullish, with moving averages and momentum indicators signaling potential for further growth. Current support lies at $80,000, with resistance levels suggesting a path to $100,000 if trends hold.

- Market Sentiment: Sentiment remains extremely optimistic, supported by historical trends of November being a strong month for Bitcoin returns. Analysts predict that barring unforeseen disruptions, Bitcoin could hit six figures soon.

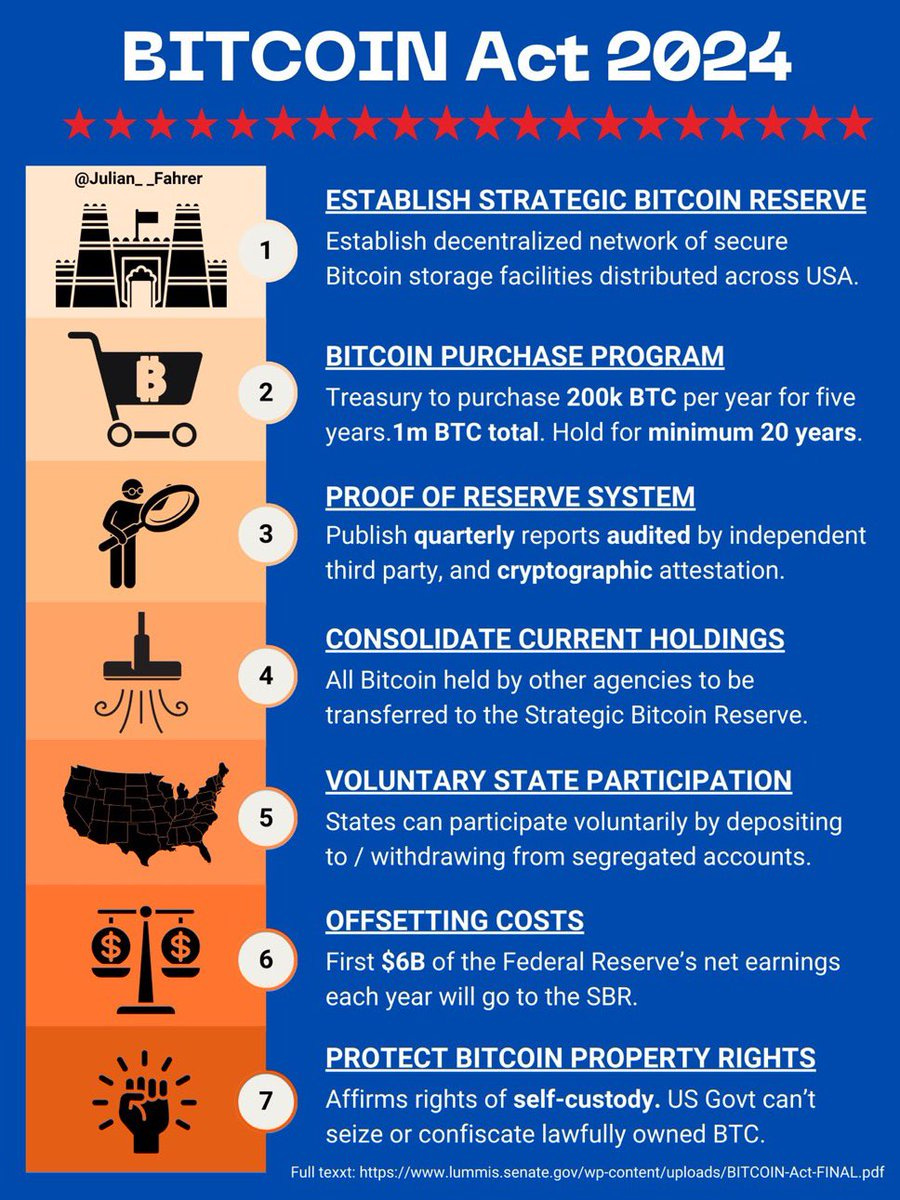

President Trump on BITCOIN:

President Donald Trump’s stance on Bitcoin has evolved over the years. Initially, as president, he was critical of cryptocurrencies, labeling Bitcoin a “scam” and expressing concerns about its volatility and potential to undermine the U.S. dollar. However, more recently, his tone has shifted significantly.

In 2024, Trump expressed admiration for Bitcoin, calling it a “marvel of technology” and highlighting its potential as a symbol of financial freedom and sovereignty. He announced plans to create a “Strategic National Bitcoin Stockpile” if re-elected, aiming to use Bitcoin as a long-term national asset. Trump emphasized that Bitcoin could reduce U.S. debt and help counter inflation, a message resonating with many crypto enthusiasts. He also opposed central bank digital currencies (CBDCs), describing them as tools for government control, and pledged to ensure the U.S. remains a global Bitcoin mining and technology leader by promoting energy independence.

This pivot towards embracing Bitcoin reflects a broader attempt to align with the growing crypto-supportive community and differentiate his policies from those of the Biden administration, which he criticized for being overly restrictive toward cryptocurrencies.

Donald Trump said “#Bitcoin and crypto will skyrocket like never before, even beyond your expectations.”

Trump’s Pro-#Bitcoin Treasury Secretary nominee Scott Bessent: BITCOIN STRATEGIC RESERVE: “Everything is on the table with Bitcoin” ON BITCOIN: “One of the most exciting things about Bitcoin is that it brings in young people and those who have not participated in markets before” Bessent also praised Bitcoin’s ability to cultivate “a market culture in the U.S.” while making users believe in a “system that works for them” WORKING WITH TRUMP: “I have been excited about the president’s embrace of crypto and I think it fits very well with the Republican Party, crypto is about freedom and the crypto economy is here to stay”

BITCOIN’s role in the prevention of WAR:

Lowery envisions Bitcoin as a form of “non-kinetic warfare,” enabling the projection of power in cyberspace without physical harm. He argues that the PoW model transforms the global electric grid into a massive computational network, creating what he describes as a “macrochip.” This setup decentralizes control and strengthens security by making data breaches or attacks costly and challenging to execute.

He has advocated for the U.S. Department of Defense to explore Bitcoin’s potential as a strategic asset, proposing that it could serve as a foundational layer for securing digital infrastructure and national interests in cyberspace. This aligns with his broader vision of leveraging technological advancements to counterbalance threats in evolving digital battlefields

How can I buy BITCOIN?

1. Choose a Platform

- Cryptocurrency Exchanges: Popular platforms like Coinbase, Binance, Kraken, and Bitstamp offer easy ways to buy Bitcoin with fiat currencies like USD, EUR, or others.

- Peer-to-Peer (P2P) Platforms: Platforms like Paxful or LocalBitcoins allow you to buy Bitcoin directly from other individuals using various payment methods.

- Bitcoin ATMs: Physical machines in some locations let you purchase Bitcoin using cash or a card.

- Brokerage Services: Companies like Robinhood or PayPal also offer Bitcoin purchases as part of their investment services.

2. Set Up a Wallet

- Hot Wallets: Software-based wallets like Exodus, Electrum, or Trust Wallet are convenient for frequent use.

- Cold Wallets: Hardware wallets like Ledger or Trezor provide higher security by storing your Bitcoin offline.

3. Verify Your Identity

4. Deposit Funds

- Bank transfer

- Credit or debit card

- Third-party payment apps (depending on the platform)

5. Place Your Order

- Choose to buy Bitcoin directly or set a limit order where you specify the price you’re willing to pay.

- Confirm the transaction, and Bitcoin will be deposited into your account or wallet.

6. Secure Your Investment

Tips for Beginners

- Start with a small amount to familiarize yourself with the process.

- Be mindful of transaction fees, which can vary across platforms.

- Research and use trusted platforms to avoid scams.

I personally use COINBASE:

Buying Cryptocurrency on Coinbase

- Create an Account

- Sign up on Coinbase using your email.

- Verify your identity by providing government-issued ID and personal details to comply with regulations.

- Connect a Payment Method

- Link a bank account, credit/debit card, or other payment options supported in your region.

- Fund Your Account

- Deposit fiat currency (e.g., USD, EUR) or directly purchase cryptocurrency with your linked payment method.

- Buy Cryptocurrency

- Navigate to the “Buy” section.

- Choose the cryptocurrency you want to buy, specify the amount, and confirm the purchase.

- Store Your Crypto

- Store your purchased cryptocurrency on Coinbase’s wallet or transfer it to an external wallet for added security.

Key Features

- User-Friendly Interface: Designed with simplicity, making it accessible for new users.

- Wide Selection: Supports over 100 cryptocurrencies, including Bitcoin, Ethereum, Solana, and Cardano.

- Security: Offers features like two-factor authentication (2FA) and insurance for digital assets stored on the platform.

- Educational Rewards: Learn about cryptocurrencies and earn small amounts of crypto by completing tutorials.

- Coinbase Pro: An advanced version for experienced traders with lower fees and more tools.

Pros

- Simple and intuitive interface.

- Strong security measures.

- Regulated and trustworthy platform.

- Available in over 100 countries.

Cons

- Relatively high fees compared to other exchanges.

- Limited control over wallet private keys if stored on the platform.

- Customer support can sometimes be slow during high-traffic periods.

The future: