In her budget address yesterday, Gov Noem called for a $71M budget cut. Off you go Legislators, flick your wands and make it happen. Makes you wonder why it was an impossible task in the past? Of note, the big three…public schools, state employees and medical will receive increases. So just how is this going to work out with promise of property tax/methodology relief?

Peterson appointed Chairman of Legislative Study on Property Tax Assessment https://www.facebook.com/share/p/1X2hs8mAg7/

-printed in *The Special* newspaper 5-1-24.

Drew Peterson, a farmer and cattle producer from Salem, South Dakota, has been appointed as the Chairman of the Legislative Study on Property Tax Assessments.

As Chairman, Peterson will oversee the comprehensive examination of the current property tax assessment system, focusing on its impact on homeowners, businesses, and the agricultural sector. With his firsthand knowledge of the challenges faced by farmers and cattle producers, Peterson will provide valuable insights and recommendations for a fair and equitable property tax assessment system.

“Nobody wants to pay more than their fair share of property taxes, so that is probably the number one goal we will work to achieve through this study. Next door neighbors and friends from across the county should pay similar taxes on similar properties,” commented Rep. Peterson.

Peterson adds, “Leadership asked me to chair this committee, so I don’t have any specific agenda or goal list—other than to be fair to the members and stakeholders, and to reach fair and equitable recommendations to send to the legislature.”

According to House Majority Leader Will Mortenson, “Rep. Peterson is a lead voice for agriculture in our legislature. I know he’ll dig into the property tax system and make sure assessments are done consistently and fairly across South Dakota.”

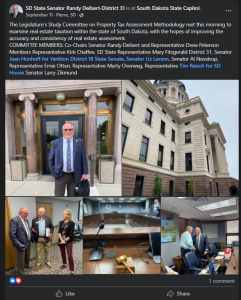

Additional members of the summer study include Rep. Kirk Chafee (Whitewood), Co-Chair Senator Randy Deibert (Spearfish), Rep. Mary Fitzgerald (Spearfish), Sen. Jean Hunhoff (Yankton), Sen. Liz Larson (Sioux Falls), Sen. Al Novstrup (Aberdeen), Rep. Ernie Otten (Tea), Rep. Marty Overweg (New Holland), Rep. Tim Reisch (Howard), and Sen. Larry Zikmund (Sioux Falls).

The Property Tax Assessment summer study will take place throughout the summer and fall of 2024. Interested citizens can find a schedule of meetings and all committee documents at www.sdlegislature.gov.

The scope of the study is to examine the methodology by which assessments are made for purposes of real estate taxation within the state of South Dakota. The study will research the relative roles of the state Department of Revenue and local government units in assessing real estate. The study may recommend policies to increase the efficiency or effectiveness of assessment. Further, the study may recommend policies with the goals of improving the accuracy and consistency of real estate assessment.

Peterson concludes, “Everyone has seen significant tax bill increases, so this issue has gotten a lot of attention lately. One thing I will make sure we consider is what rates and values will be in the future and work off of that information instead of looking backwards. Rates and values differ from county to county and across the property classes (residential, ag, commercial (other)). Some went up quickly 5 years ago and some have been more recent.

I don’t want recency bias to dictate long term decision making in the recommendations that come out of this group. We legislate for the long term.”

_____________________________________________

Interim Study begins: Property Tax Methodology – Today we reviewed state statutes on Property Tax Assessment, heard from Rep Chafee, Pennington, Brookings County Directors of Equalization, and discussed our future meetings. Every legislator on the committee is working diligently to reduce property taxes in South Dakota. Looking forward to next session where we can submit bills before the legislative body.

Spent part of the day in Hot Springs with fellow legislators. We have formed a group aimed at reducing property taxes. I am confident our legislation will earn the support of our constituents and legislators in January.